Bankrate payroll deductions calculator

This Payroll Deductions Calculator will help you to determine the impact that changing your payroll deductions can have on your financial situation. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Easy Cap Rate Calculator Rentspree Blog

First enter the net paycheck you require.

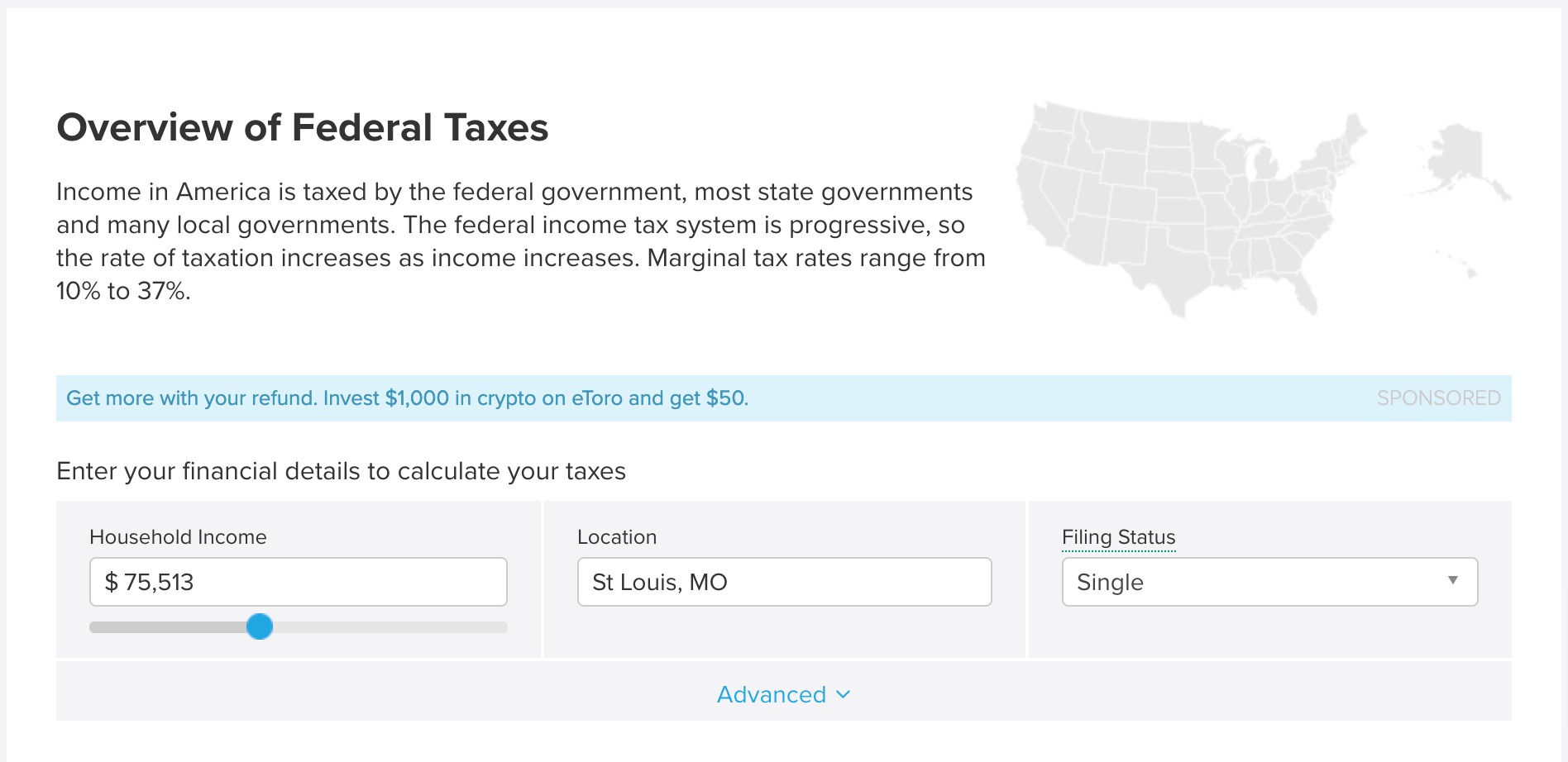

. You can enter your. See how your refund take-home pay or tax due are affected by withholding amount. 1547 would also be your average tax rate.

It can also be used to help fill steps 3 and 4 of a W-4 form. This calculator helps you determine the gross paycheck needed to provide a required net amount. For example if an employee makes 25 per hour and.

Then multiply that number by the total number of weeks in a year 52. Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

Your taxes are estimated at 11139. How to calculate annual income. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

How It Works. This calculator uses the withholding. Then enter your current payroll information and.

This calculator helps you estimate your average tax. Use this simplified payroll deductions calculator to help you determine your net paycheck. What is your tax bracket.

Then enter the hours you. Multiply the hourly wage by the number of hours worked per week. Use this calculator to help you determine your paycheck for hourly wages.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Estimate your federal income tax withholding. This is 1547 of your total income of 72000.

Earned income tax credit calculator. Your income puts you in the 25 tax bracket. The result is that the FICA taxes you pay are.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. First enter your current payroll information and deductions. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

For example if an employee earns 1500. Use this tool to. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay.

It will confirm the deductions you include on your.

The 4 Best Cost Of Living Calculators Ciresi Morek

Income Tax Calculator Colorado Salary After Taxes Income Tax Payroll Taxes Federal Income Tax

Stubhub Pricing Calculator Irs Taxes Irs Pricing Calculator

Easy Cap Rate Calculator Rentspree Blog

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

Quick Ratio Calculator Acid Test Calculator

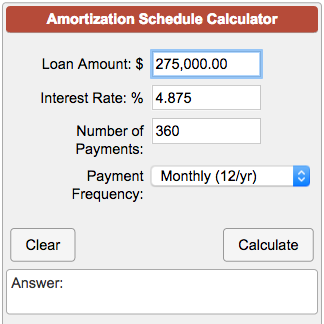

Amortization Schedule Calculator

Super Bowl 51 Predictions In A Game Of Inches Super Bowl 51 Super Bowl Live Superbowl 2017

What Is Net Income Definition How To Calculate It Bankrate

Taxation Services In Hyderabad Tax Debt The Motley Fool Tax Free Investments

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Stubhub Pricing Calculator Irs Taxes Irs Pricing Calculator

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Hire Freelance Independent Consultants Talmix Mba Co Mba Independent Consultant Hiring

The 20 Best Online Tools To Calculate Your Income Taxes In 2021